Below is a case study I felt compelled to publish after speaking with several SaaS startup companies with Customer Success departments. It starts at the foundational level, but even seasoned Customer Success leaders should find some value along the way. There are many facets of Customer Success, Part 1 focuses primarily on revenue retention aka reducing customer churn.

Read below if you manage a Customer Success group and would like some thoughts on how to improve your performance, identify potential relationship ending challenges with your customers, and more importantly, see how one company went about reducing churn (with significant SUCCESS)

“In many companies, the costs of Customer Success are easily identifiable, but the benefits are not. This can lead to an underappreciation and eventually, underinvestment in the Customers Success function.”

SUMMARY UPFRONT:

In many companies, the cost of Customer Success is easily identifiable, but the benefit is not. This can lead to an underappreciation and eventually, underinvestment in the Customer Success function.

- Get leadership buy-in and have relevant departments on the project (Sales, Marketing, Product)

- Create a consistent definition for when a customer is officially lost (Churn)

- Identify and document in writing the different reasons customers Churn

- Identify and define At-Risk events (Symptoms) that precede customer Churn (often they aren’t the same)

- Define the events that remove a customer from At-Risk status (This is harder than you think!)

- Develop a consistent financial measure for churn and At-Risk; annual revenue, lifetime value, or some measure that allows for prioritization and the ability to develop an ROI

- Develop CRM functionality to easily allow the team to classify At-Risk and Churn reasons

- Provide company-wide visibility at the account and category level for each status (real-time alerts)

- Develop and train the different customer scenarios and how Customer Success Associates are to respond to At-Risk events when they happen

- Conduct regular meetings to report At-Risk and Churn with the broader team and come away with action items (that last part is critical, without action items and accountability, it’s just information)

- Hold the team accountable for identifying At-Risk accounts and resolving them (Peer comparison)

- Iterate, iterate, iterate, this is a never-ending, ongoing project that will evolve with your customers

OVERVIEW:

Customer churn reduces revenue and limits growth potential. This is blatantly obvious but much harder to quantify in a rapidly growing company as one might think. In many companies, it represents a hidden opportunity cost, a reduction in revenue that everyone knows exists, but few can calculate with confidence, especially if the company is growing rapidly. This is especially true in a non-contracted SaaS model, but similar principles apply to all SaaS models. Because the costs of Customer Success are easily measured while the benefits are not, it may lead the executive team to devalue the function. Afterall, Sales and Marketing can easily quantify their value in new sales. As a Customer Success professional, you are probably no stranger to this comparison! Keep reading if you would like a more effective response.

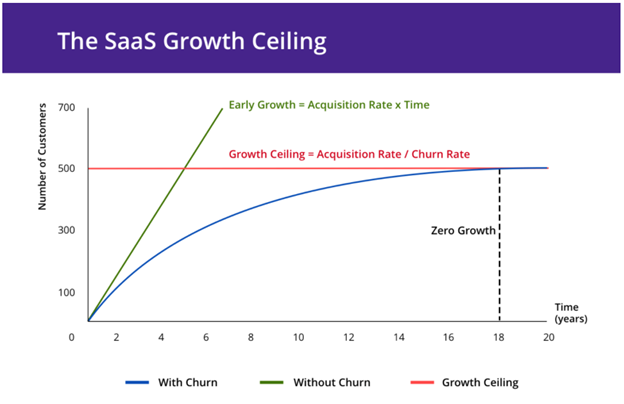

This chart comes from a great article on ChartMogul titled “The SaaS Growth Ceiling: What happens when churn takes hold”. I encourage you to check it out. The chart demonstrates that the exponential impact of churn will eventually top out your company’s growth potential.

THE SITUATION:

A B2B SaaS client I recently worked with had no documentation on customer turnover (why customers left), nor was there a good definition that accurately measured when a customer stopped purchasing. Although their users preferred to use a single solution, exclusive contracts were not common in the industry and switching costs were low. As a non-contracted transactional provider (a company that is paid per transaction) with tens of thousands of transactions, this was particularly challenging. They had a broad mix of customers and product needs ranging from self-serve single users to customers with literally hundreds of thousands of transactions across dozens of product configurations. Complicating the matter further, many providers were integrated with 3rd party systems that limited the performance of the platform.

“At some point, someone really needs to do something about those dead customers piling up in the backroom.”

DEFINING THE PROBLEM:

Through data analysis, we determined that ~ 95% of Customer Success customers (those customers above a certain spend threshold) never purchased again if they went 45 days without using the product. This is not a performance metric, there was no value in moving that number to 30 days or 60 days, nor is it an industry standard, it simply reflects the way the current customers of this particular client stopped spending for good. (Critical because of the lack of contract) When the data was further refined, we discovered that larger customers spending over $8,000 a year, had statistically discernible purchasing patterns. These patterns allowed us to identify when customers were At-Risk based on their spending behaviors, even before they complained (if they ever did).

Identifying when churn happens and quantifying the impact allows companies to better forecast and understand the size of the overall opportunity, but it does not address the cause or reduce the frequency. In many cases, your customers decide to leave you long before they change or stop spending. The comparison to medical mortality (Cause of death), is a compelling one. With modern-day medicine, it is not acceptable to have a high number of unexplained patient deaths. Your customers should be the same. At some point, someone really needs to do something about those dead customers piling up in the backroom!

Showing senior management a consolidated list of deceased customers with the overall cost to the organization generally sparks some interest. Identifying the symptoms that occurred prior to death, defining them so they can be identified across clients, and eventually developing effective treatments to prevent them in the first place, should generate all the attention you need! (We will save Customer Health Scores for another article)

“In many cases, your customers decide to leave you long before they change or stop spending.”

ROOT CAUSE

For a better understanding of the cause of churn, we listened to hundreds of calls and read through even more e-mail transactions of past customers. We interviewed the Success, Support, and Sales teams who were more than happy to provide anecdotal evidence as to why they thought customers churned. We also spoke to former and current customers. From this pool of information, we developed a list of potential churn reasons and refined them down to the most common. Some obvious ones that are on most company’s lists such as “Product Performance” and “Product Gaps”. Some issues that were common enough to make the list were product or industry-specific while others were more common across most companies.

“In several cases, the customer left our client for different reasons than new customers would not purchase.”

In all, we identified 15 primary reasons for churn with several additional sub reasons and labeled each former customer. We measured the impact based on annual sales so it was easy to stack rank the reasons in order of importance, factoring out any special cause customers. Not all churn data corresponded with the closed-lost categories from Sales. In several cases, customers left this client for different reasons than new customers would not purchase. Too much focus on new sales would never identify these gaps. If they were identified, prioritizing the resolution would be nearly impossible. In the end, we had far more information on why we lost customers than why we lost potential sales. Information that did not exist before we started the project.

Ultimately, in a SaaS business, the goal should be to proactively address most issues before the client is even aware, but few systems are sophisticated enough to execute such a strategy. The next best thing is to identify At-Risk reasons; symptoms, that if left untreated, may lead to the loss of your customer. Some of these At-Risk reasons corresponded directly to the churn reasons. For example, a customer complaining about a product gap that is material to their business is likely to leave if they cannot get that need resolved. On the other hand, we noticed many customers left after the main contact changed. The customer was not lost specifically because the main contact changed, but the event itself exposed many different potential problems based on the new client contact. Was the new client internal? (Less risky) External? (Riskier) If external, what was the previous company, and what competitor did they use and why? Already you can see how this information changes the Success Associate’s response to treating the symptom. It is the same for the competition. Customers will be lost to the competition and the competition is relevant in any risk discussion, but it is not the reason you can resolve. Instead, identify why the customer went to the competition: Did the competitor offer a better price, more functionality, integration? Those are the reasons you can push the organization to do something about, or better yet solve before the customer leaves.

“Ultimately, in a SaaS business, the goal should be to proactively address most issues before the client is even aware”

SOLUTION:

Overall, the 15 Churn reasons and 14 At-Risk reasons were used to escalate risk to the broader company, prioritize the product development team and focus Success Associate activity. Definitions for each risk were documented as to what constituted the risk and under what circumstances would a customer be removed from At-Risk status (this is a difficult but critical step). Annual revenue was used to quantify At-Risk and churned revenue. Scenarios were developed around each At-Risk reason and the multiple situations that could exist. Product training and the best techniques to treat the risk were developed and trained to the Success Associates. The overall Success and Support teams were trained to actively and passively be on the look-out for risk and how to resolve it once it was identified. At-Risk was added to the CRM (Salesforce in this case) so anyone in the company could see when a customer was At-Risk, and reporting was developed to identify how much each category was worth in annual revenue. Meetings were held bi-weekly to review the status of At-Risk companies.

An additional project was scoped but not accepted to provide an omnichannel listening post. This would identify each client contact and classify the purpose of the contact consistently, with overall client reporting to the Success Associate across all communication channels and users by customer. This is the next step in the evolution of this B2B organization.

“By the end of the first phase of the project, the product team was actively working on 5 of the 6 top product gaps (always known but never prioritized).”

IMPROVEMENTS:

Midway through the project, the Product team had a quantified list of risks (with actual revenue At-Risk) to better prioritize enhancements and a specific list of clients with which to meet and develop business requirements. By the end of the first phase of the project, the product team was actively working on 5 of the 6 top product gaps (always known but never prioritized). The At-Risk list also focused the Success Associate’s behavior, changing their goals to focus on the most pressing clients first. In Q1 2020, the first full quarter the Success team fully used this process (training was not even complete) the team began to make significant progress.

RESULTS:

- 97% retained revenue (a record to that point)

- 93% CSAT across the Success team (the highest on record)

- Net Promoter Score (NPS) +73 for Managed Customers

- Employee satisfaction 4.8 on a 5.0 scale (highest in the company)

- Upsells were 120% above any previous quarter. Not a project expectation, we believe Success Associates were more involved in the client details. Reporting challenges were also discovered.

- Cost of Revenue Managed metric was established with finance

- Sales team handoff collaboration was developed to assist with onboarding

- The total benefits are still ongoing and the amount proprietary but suffice to say it had 7 figures!

Please feel free to add comments or ask questions. Interested in a complimentary review of your Success process or anything contact center or sales related? Drop me a note on LinkedIn. Happy to chat! https://www.linkedin.com/in/danielhoesing/ or Email danielhoesing@IPMConsultingLLC.com.